ETF Of The Week: Trade War Fund Arrives

TWAR is ETF of the Week on ETF.com!

Setting aside whether or not tariffs are good trade policy, prolonged tariffs will have drastic impacts on the U.S. economy, as companies are forced to raise their prices to compensate for higher raw goods prices.

What’s bad for the U.S. consumer could be good for ETF investors, however.

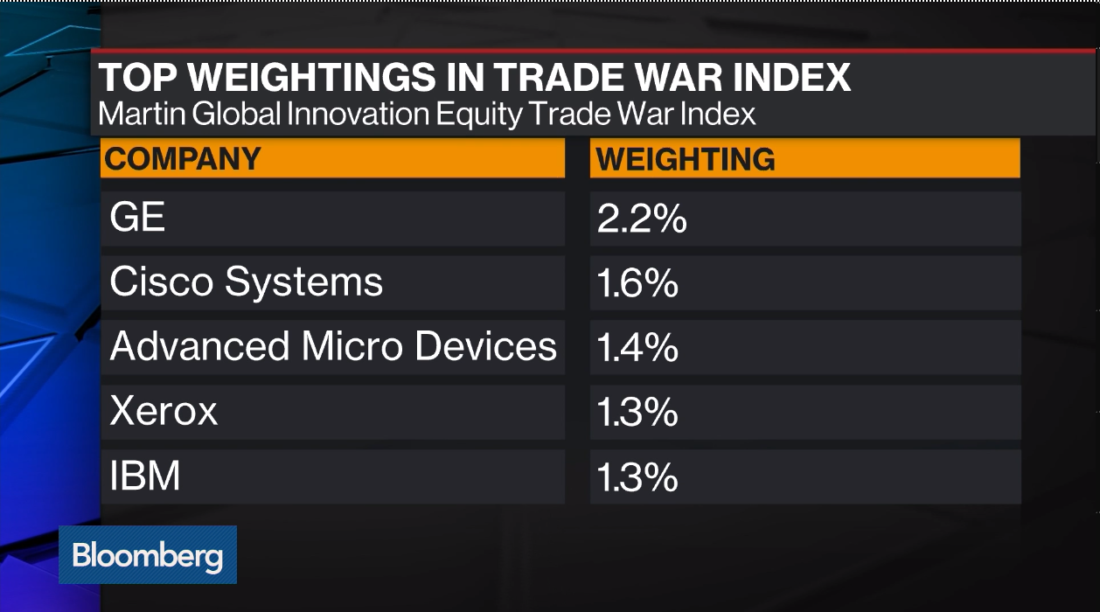

Earlier this week saw the timely launch of a new ETF designed specifically to benefit from a prolonged tariff fight: the Innovation α Trade War ETF (TWAR)

It is our great pleasure to be featured as ETF of the week on ETF.com. Whether you put it down to incredible forsight or fortuitousness (we of course think it is a healthy mix of both), we could not have picked a better week to launch!

Read the full piece here